Against this, in a daily taxable investment portfolio wherever just one would pay out cash gains taxes on $one,427, if this investment have been manufactured via a tax-exempt account, growth wouldn't be taxed.

When techniques one and a couple of are actually finished, you never ever really need to repeat them yet again. Go on to this webpage and click within the "Spend" tab to remit payment for your upcoming orders and once-a-year renewals.

In this example, delaying the withdrawal to the next calendar year – if possible – may possibly cause an Total tax savings (assuming you won’t operate in to the very same problem following year).

The foundations governing these accounts are thorough and comprehensive. We’ll provide you with a fast evaluation, however you’ll need to do some serious research prior to making a last selection. In the event you’re undecided, look at consulting a professional advisor.

With yields like that, P2P Lending is among the best substantial-yield alternative investments. Naturally, there’s nevertheless some hazard of default, so do your exploration and thoroughly consider your investment options just before undertaking any P2P lending.

Business enterprise Tax Warranty: If you employ copyright to file your company tax return, you'll be coated by a combination of our one hundred% correct calculations, optimum savings and audit assist guarantees. If you fork out an IRS or point out penalty (or curiosity) thanks to a copyright calculation mistake or an error that a copyright professional built whilst performing for a signed preparer for the return, we'll fork out you the penalty and fascination. You will be answerable for paying any further tax legal responsibility you could owe. If you get a bigger refund or smaller sized tax due from another tax preparer by filing an amended return, we'll refund the relevant copyright Are living Business federal and/or point out order price paid.

Similarly, Congress has repeatedly amended portion 529 of the Internal Revenue Code to help you inspire families to put aside resources for educational fees in a tax-advantaged account called a 529 Program.

It’s a good idea to periodically review your tax-advantaged (and various) accounts. An annual evaluation is normally advisable to make certain your investments keep on to align with all your prolonged-phrase ambitions and threat tolerance.

Investing in alternative investments is speculative, not ideal for all purchasers, and generally supposed for knowledgeable and complicated buyers that are prepared and in a position to bear the substantial economic challenges in the investment.

All program written content is sent in created English. Closed captioning in English is accessible for all movies. There won't be any Stay interactions in the study course that needs the learner to speak English. Coursework must be finished in English.

But if those same assets are held inside of a tax-exempt account, there generally isn’t any tax with your withdrawal – provided that you fulfill the requirements for the kind of tax-exempt account you own.

The following copyright On the web gives may very well be readily available for tax yr 2024. Intuit reserves the proper to modify or terminate any present at any time for almost any motive in its sole discretion.

Unique Retirement Accounts or IRAs are arrange by the person Keeping the account. You select the provider, which gives you much more options.

copyright Are living - Tax Guidance and Specialist Overview: Access to a specialist for tax questions and Skilled Assessment (a chance to Possess a tax skilled review) is incorporated with copyright Stay Assisted or being an update from another copyright solution, and out there via December 31, 2025. Entry to an authority for tax inquiries can also be provided with copyright Stay Full Company and available via December 31, 2025. If you employ copyright Dwell, Intuit will assign you a tax specialist determined by availability. Tax expert availability might be limited. Some tax Look At This subject areas or scenarios will not be incorporated as component of the provider, which shall be determined within the tax skilled's sole discretion. The ability to retain precisely the same specialist preparer in subsequent several years is special info going to be according to an expert’s alternative to continue employment with Intuit as well as their availability at the moments you select to prepare your return(s).

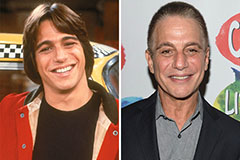

Tony Danza Then & Now!

Tony Danza Then & Now! Jenna Jameson Then & Now!

Jenna Jameson Then & Now! Loni Anderson Then & Now!

Loni Anderson Then & Now! Brooke Shields Then & Now!

Brooke Shields Then & Now! Kerri Strug Then & Now!

Kerri Strug Then & Now!